We're an

Equifax Sales Agent

Kick-start the new year with these two new lending tools

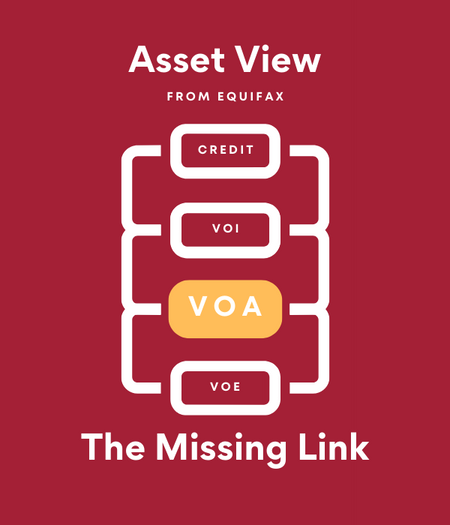

We understand the process of collecting a borrower’s credit, income, and asset information to complete a URLA can be time-consuming and inefficient. We have solution—with no need to chase down information or wait for a borrower to provide the necessary documents!

Asset View from Equifax provides borrowers an easy-to-use, self-service portal that connects you to your borrowers’ bank accounts and helps expedite the underwriting process. And right now, it’s FREE to our customers.*

Reach out to learn more!

*This complimentary access is currently offered to direct lenders only and lasts until Equifax receives GSE approval (D1C and AIM). Once GSE approval is received, the offer expires, and you may purchase Asset View for $5/report with free unlimited refreshes for 60 days, no matter how many accounts are on the report.

Along with the new year comes a continued push for mortgage lenders to become more financially inclusive. But how do you do that easily and affordably without taking on too much risk? Equifax can help you evaluate the reported 28 million people in the U.S. who are considered credit invisible—at no additional cost! Here’s how:

Equifax’s Trended Credit*Hi-Lite Plus report (coming Q1 2023) will soon include telco, pay TV, and utilities insights to help you reach creditworthy consumers with thin credit files—and those with traditional credit files who might benefit from expanded financial profiles.

These differentiated insights will be delivered alongside our mortgage credit report, at no additional cost to lenders, helping you simplify the manual underwriting process, improve the customer experience, and reduce lender costs. Find out how many of the reported 28 million “credit invisibles” in the U.S. might be your next borrowers!