We're an

Equifax Sales Agent

Mortgage Services

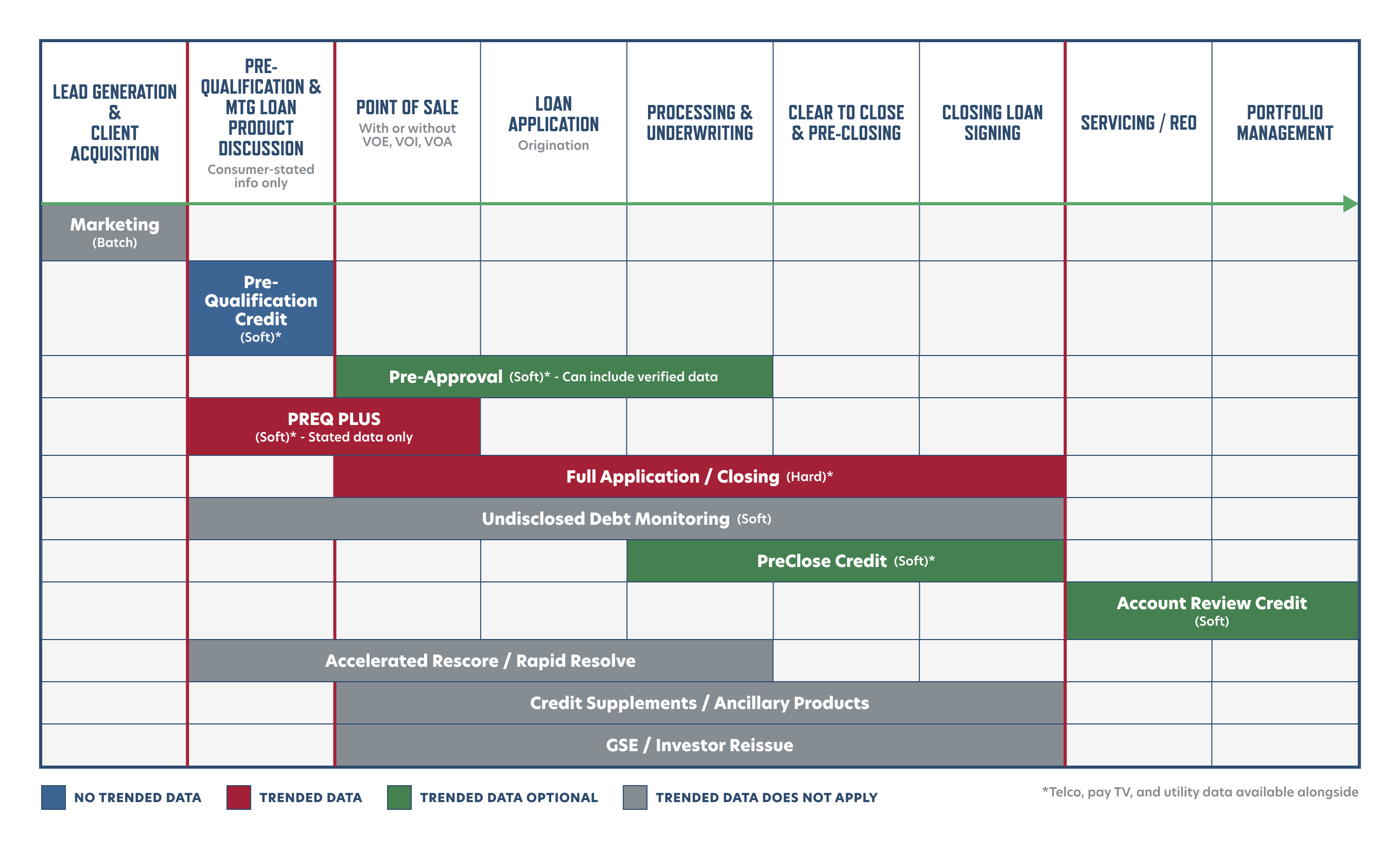

Equifax mortgage products and solutions throughout the loan life cycle.

Soft Inquiry Options

Pre-Qualification Credit Report

This report provides upfront insight into a consumer’s potential loan eligibility through an initial credit check and score. It generates a soft inquiry on the credit file, with no negative impact to the consumer’s credit score and no requirements for a firm offer of credit or adverse action. Allow borrowers to shop without prompting prescreen triggers.

Pre-Qualification PLUS Credit Report

This report provides the same benefits as the Mortgage Pre-Qualification Credit Report plus 24 months of trended credit data. Part of the Government Sponsored Enterprise (GSE) early assessment programs.

Pre-Approval Credit Report

This report provides the same benefits as Pre-Qualification PLUS but with the addition of verified data for extension of credit up to 10 days prior to closing.

Point of Sale to Closing

Trended Credit*Hi-Lite (Tri-Merge Report)

This report expands the credit information used for evaluating a home loan applicant by supplementing the traditional moment-in-time snapshot of an applicant’s credit balances with a more dynamic two-year view of payments and balances.

Edited Credit*Hi-Lite (Supplements)

This service allows one or more of the items from the Trended Credit*Hi-Lite report to be updated. The creation of an ECHL does not impact an applicant’s credit score, but it can impact ability-to-pay factors such as the applicant’s debt-to-income (DTI).

Undisclosed Debt Monitoring (soft inquiry)

This proprietary platform monitors the “quiet period” between the time of the original credit report and the closing of the loan. It also includes daily activity alerts that might represent potential risk to the lender if undisclosed liabilities are not identified and addressed prior to closing the loan.

Preclose Compare (soft inquiry)

This report is pulled approximately 10 days prior to closing to identify any changes to a borrower’s credit data since origination; it is especially helpful in identifying undisclosed debt.

Portfolio Management

Account Review

Your mortgage portfolio is a big part of your balance sheet, so it’s vital to stay up to date on any changes to your borrowers’ credit profiles since origination.

- Are your borrowers inquiring elsewhere about a refi? We can help you retain your existing borrowers with retention alerts and know within 24 hours if they apply elsewhere.

- Has a borrower’s creditworthiness plummeted since origination? We can tell you their current credit scores, whether they’re behind with other lenders, and if they have excessive credit card debt. Leverage regular portfolio reviews to keep an eye on and manage the risk in the portfolio.

- How would you know if a borrower opened a second lien behind yours, resulting in a combined loan-to-value (CLTV) over 100%? We can append property data to a portfolio review and let you know their mortgage and home-equity pay histories and which liens are recorded against your collateral.

Lead Generation

Marketing

Locate consumers who meet the credit qualifications for a mortgage loan by using our prescreening products. Our property data will help you pinpoint borrowers who are model candidates for refinancing. Leverage our non-FCRA data to easily identify ideal prospects in LMI/MMCT tracts for Fair Lending and CRA programs.