We're an

Equifax Sales Agent

Banks

Embracing a consumer-centric approach.

We know that the shift of focus to digital is changing the financial services landscape. Consumer expectations and demands are changing, and your consumers have more control than ever when obtaining financial services.

To be successful and maintain relevance, bankers like you shift their focus and embrace the new digital and consumer-centric reality. They are adopting a more proactive strategy to reach consumers where, when, and how they prefer to be reached while also heightening their focus on combating fraud in an increasingly digital world.

Built to serve the financial services industry’s needs, we are dedicated to providing innovative ways for banks of all sizes to better serve their customers (both consumers and businesses) and make more confident decisions.

From credit risk decisioning and prospecting to onboarding and account management, Confluent Strategies and Equifax help you transform to meet the needs of today’s digital consumer. Leveraging our deep industry expertise along with our unique data, innovative analytics, and technology, we build essential solutions that help you reach consumers where, when, and how they prefer to be reached with the right products at the right time.

We help our banking partners:

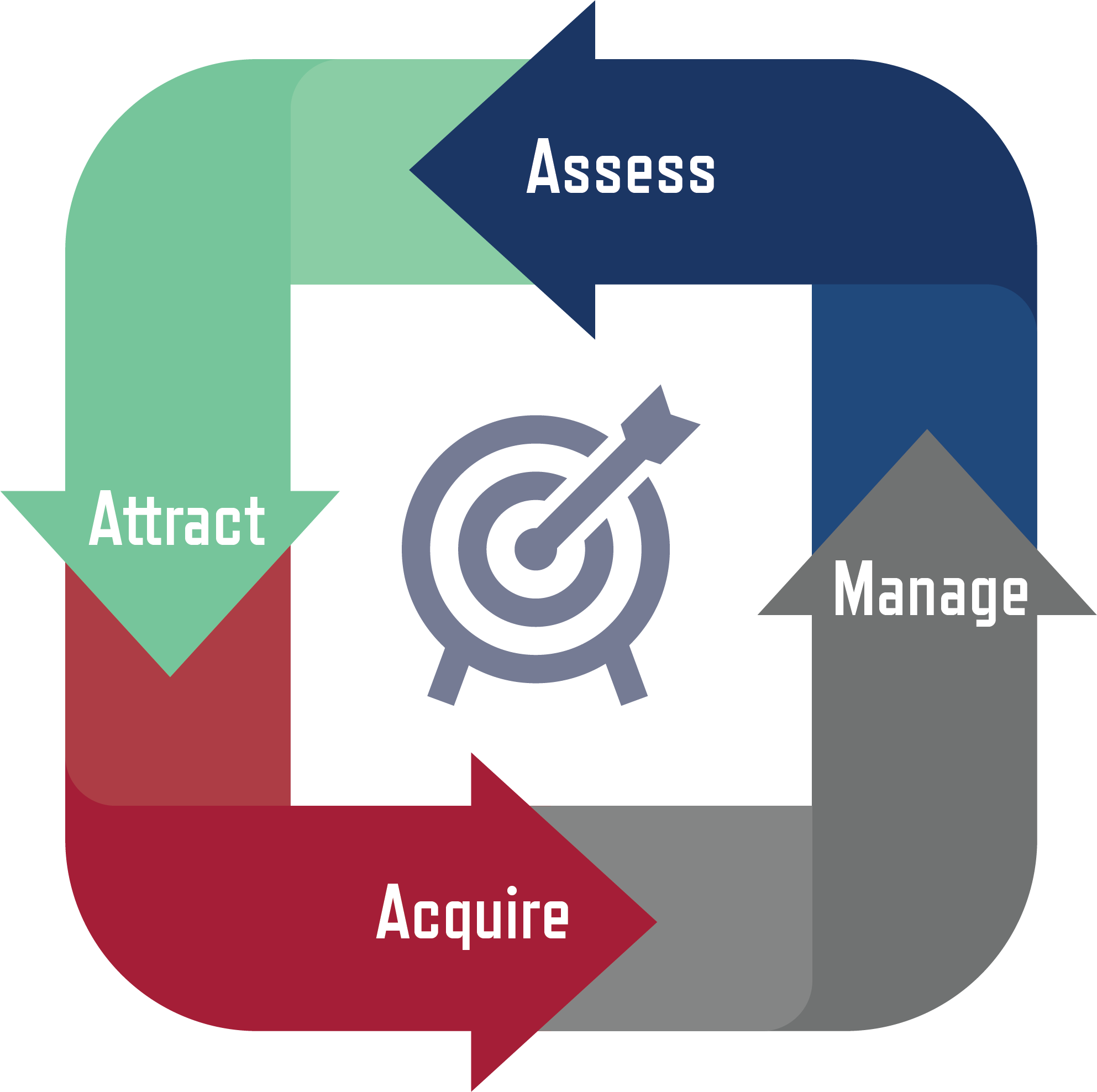

Assess

- Understand competitive position and industry trends

- Harness and understand large amounts of data to inform key business strategies

Attract

- Target the right customer, with the right offer, at the right time, through preferred channels

- Identify and extend the next best offer

Acquire

- Find and optimize opportunities for growth across customer acquisition and retention

- Minimize risk and better predict consumer credit behavior

- Enable and improve the digital customer experience

Manage

- Minimize the cost of fraud throughout the customer lifecycle

- Assist with risk management and regulatory compliance

- Predict likelihood to default, minimizing bad debt and charge-offs

- Drive higher customer lifetime value and deeper loyalty

The Equifax Difference

- A unique approach to innovation and collaboration: We partner and co-innovating with key players (from the industry and technology) to invest and build the latest agile technologies and solutions to fuel the creation of insights.

- Expertise and understanding of the industry: We provide thought leadership on the issues and trends that matter most to our customers.

- Unmatched breadth and depth of data: We have access to exclusive, reliable, and diverse data across credit, fraud, wealth, employment, and income, including partnerships with key 3rd party data providers.

- Innovative and configurable analytics capabilities to enhance data access, modeling, and reporting: Our flexible technology allows us to facilitate capabilities across different platforms and delivery channels. This helps you get from analytics to production faster and ensures you’re putting your data and insights into action.

Confluent Strategies and Equifax will help you:

Grow your business

- Broaden reach and expand your universe of prospective customers, both individuals, and small businesses.

- Deepen relationships and increase customer lifetime value by offering the right product to the right customer at the right time.

- Increase the precision of targeting efforts and improve return on marketing investments.

- Leverage non-traditional data to target a wider audience of consumers.

Protect your business

- Leverage traditional and non-traditional data to better assess risk.

- Better enable regulatory compliance with automated and streamlined processes and monitoring alerts.

- Recognize, identify and reconcile fraudulent behaviors and patterns to help protect organizational reputation with support for your KYC and AML solutions.

Reduce losses

- Better assess account risk to help minimize exposure and losses using trended and alternative sources of data.

- Identify customers most likely to default or declare bankruptcy.

- Reduce delinquency by proactively monitoring trends in payment behavior and predicting the likelihood to repay.

For more information about how Confluent Strategies can help bankers like you better serve your customers, click here.