We're an

Equifax Sales Agent

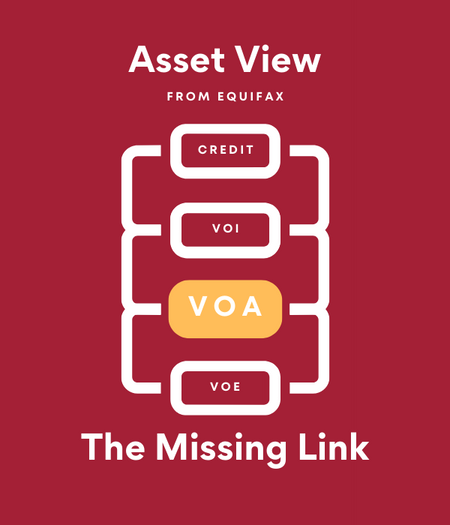

Expedite VOA for you and your borrowers with Asset View.

We understand that as a mortgage lender, the process of collecting a borrower’s credit, income, and asset information to complete a URLA can be time-consuming and inefficient. You often chase down information or wait for a borrower to provide the necessary documents to get the loan into underwriting, only to find that the data is outdated and must be reordered.

What if there were a way to streamline this process by allowing borrowers to provide you with direct and secure access to their accounts to verify their assets?

Introducing Asset View from Equifax.

Asset View VOA provides borrowers an easy-to-use, self-service portal that will connect you to their bank accounts and help expedite the underwriting process.

Benefits of Asset View:

- End-to-end data encryption

- Easy-to-use borrower email flow is both PC- and mobile-ready and able to include lender branding.

- Banking and investment account data supported two- or 12-month report options

- Designed to mirror GSE requirements (GSE validation—coming soon)

- Unlimited refreshes for up to 60 days

Because we are so excited about this solution, Equifax is offering it FREE to our customers.*

And we won’t leave you with questions; our customer support team is ready and willing to help with any questions you might have.

| What makes Asset View different? |

95% coverage on consumer checking account banking activity in the U.S.**

Source: Envestnet/Yodlee

**Consumer consent is required to access applicable account information.

*This complimentary access is currently offered to direct lenders only and lasts until Equifax receives GSE approval (D1C and AIM). Once GSE approval is received, the offer expires and you may purchase Asset View for $5/report with free unlimited refreshes for 60 days, no matter how many accounts are on the report.