We're an

Equifax Sales Agent

What is BNPL, and how does it affect your business?

Buy Now, Pay Later (BNPL) is a short-term installment loan or line of credit made up of individual short-term installments at point of service (POS). The typical duration is six weeks and paid in four biweekly installments—a.k.a. “pay-in-4.” The consumer usually does not pay interest; instead, the merchant pays a transaction fee. BNPL is typically used for retail purchases like electronics, clothing, household goods, etc.

BNPL’s rise in popularity

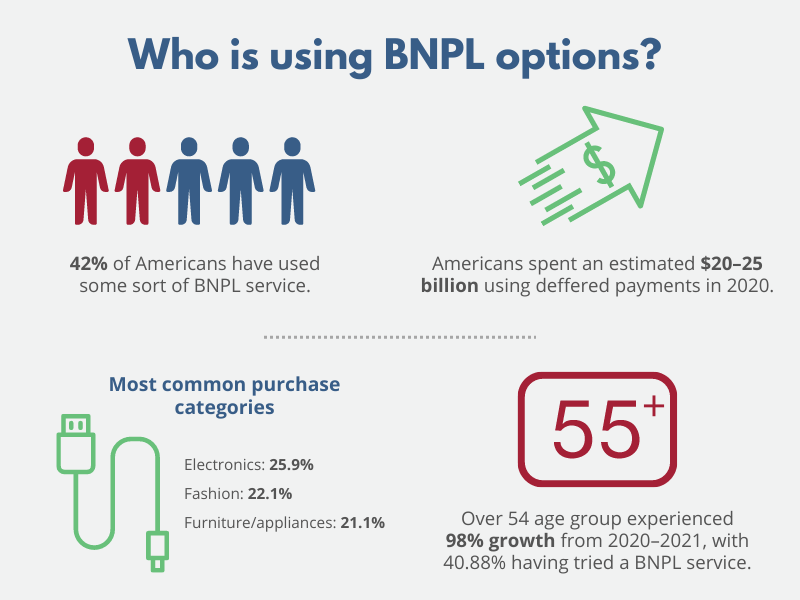

Like the layaway options of the 20th century, BNPL allows consumers to break larger purchases into smaller installments—without having to use a credit card. And it suits the lifestyle of modern consumers, especially Millennials and Gen Zers, who tend to prefer mobile pay options and subscription-like services. In 2010, BNPL represented nearly 2% of ecommerce transactions, and by 2024, it is predicted to reach about 4.5%. No doubt, the rise in online shopping during the COVID-19 pandemic has contributed to the increased availability and usage of BNPL services.

Mercator Advisory Group sized the U.S. BNPL lending market in 2019 at about $3 billion. In 2020, BNPL experienced a 1,200% increase to $39 billion. By 2024, the market size is anticipated to surpass $100 billion.

Equifax credit reports now include BNPL

BNPL volume has surged over the past two years, and we recognize the challenges this presents to lenders and consumers alike. Consumers who have BNPL loans should be able to benefit from a positive payment history, and lenders should have visibility into a complete picture of a person’s financial obligations in order to lend responsibly. Feedback from our traditional financial institution customers who also offer BNPL products have indicated that they want them represented alongside the Equifax consumer credit file, as BNPL obligations are credit obligations.

To that end, Equifax was the first to formalize the inclusion of BNPL payment information in a consumer credit report. As of February 24, 2022, we now accept BNPL payment information using the new industry code FO. Adding BNPL tradelines to our core credit file enables all Equifax credit customers to provide a score consistent with the consumer’s payment behavior and could allow the consumer additional lending opportunities.

Inquiries for qualified BNPL loans are treated as soft inquiries; therefore, applying for a BNPL loan will not impact a consumer’s credit score.

Keeping up with changing consumer expectations

For financial institutions to remain competitive, they must focus on adapting to the evolving needs of the consumer around digital and overall experience while being able to confidently say ‘yes’ more. Finding ways to incorporate new lending options, such as BNPL, into the credit landscape helps us do just that.