We're an

Equifax Sales Agent

Achieve superior business delinquency prediction.

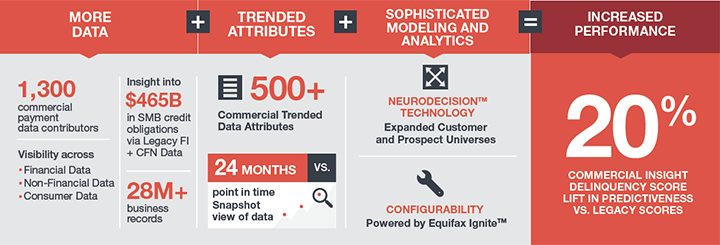

As consumers’ and prospects’ financial conditions change in an inflated market, it can be difficult to assess their future ability to pay their bills. Commercial Insight™ Delinquency Score (CIDS) from Equifax helps you combat the uncertainty and sharpen your commercial decisioning process.

CIDS is a high-performance solution that predicts the likelihood of a business incurring severe delinquency (91 days or greater), charge-off, or bankruptcy on financial accounts within the next 12 months. This valuable score uses the power of Equifax’s commercial and consumer credit databases and the Commercial Financial Network (CFN) combined with trended data, public records, firmographic, and nonfinancial information, where available.

CIDS has a range of 101–999, where high values indicate lower risk of severe delinquency. The scores can be used as is or can be easily tailored for your business.

Score Options

| CIDS | Optimized for common use cases. |

| CIDS—Blended Data | Adds the ability to include personal credit information on the business principal, owner, or guarantor with business credit information from the Equifax CFN database. |

| CIDS—Configurable Option | Adds the ability to choose which data offerings are best for your use-case. We are available to help you optimize selections. |

Who can be scored?

Businesses that have at least one active commercial trade (reported in the past 60 months) and a valid address and/or a consumer trade reported are eligible to receive CIDS. If businesses, at the time of scoring, have an existing bankruptcy or are in the process of filing for bankruptcy, a zero will be assigned.